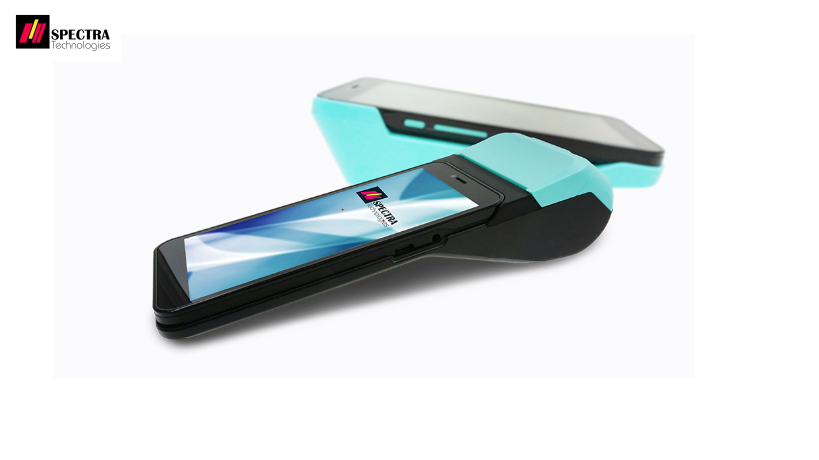

Revolutionizing Transactions: Embracing the Power of “Tap to Phone” with Spectratech

In the ever-evolving landscape of financial technology, a groundbreaking innovation is reshaping the way businesses process payments – “Tap to Phone.” At the forefront of this revolution stands Spectratech, a visionary company that has harnessed the potential of this transformative technology. This blog will delve into the nuances of “Tap to Phone” technology, examining its profound impact on the financial industry and highlighting how Spectratech is leading the way towards a more seamless and efficient future for transactions.

Understanding “Tap to Phone” Technology:

“Tap to Phone” technology, also known as SoftPOS (Software Point of Sale), marks a significant departure from traditional point-of-sale systems. By utilizing the ubiquity of smartphones, this technology transforms these devices into secure and versatile payment terminals, enabling businesses to accept payments directly through mobile devices.

- Streamlining Contactless Payments:

The core of “Tap to Phone” lies in its ability to simplify contactless payments. Customers can effortlessly complete transactions by tapping their contactless cards or mobile devices against the merchant’s smartphone or tablet. This streamlined process eliminates the need for physical cards to be inserted into traditional card readers, resulting in faster and more convenient transactions.

- Accessibility and Affordability:

A key advantage of “Tap to Phone” is its accessibility. Leveraging smartphones allows businesses to adopt this technology without the need for additional expensive hardware. This affordability makes “Tap to Phone” an attractive option for businesses of all sizes, empowering even small merchants to seamlessly integrate digital payments.

- Enhanced Mobility:

“Tap to Phone” liberates businesses from the constraints of traditional point-of-sale hardware. Merchants can accept payments anywhere – in a physical store, at an event, or on the go. This enhanced mobility aligns with the evolving needs of modern businesses, providing flexibility in when and where transactions take place.

Spectratech’s Innovations in “Tap to Phone” Technology:

As a trailblazer in the financial technology sector, Spectratech has played a pivotal role in advancing the capabilities of “Tap to Phone” technology. Let’s explore some key innovations that set Spectratech apart:

- Cutting-Edge Security Features:

Security is paramount in financial transactions, and Spectratech places a high priority on it in its “Tap to Phone” solutions. Incorporating advanced encryption protocols and secure authentication methods, Spectratech ensures that every transaction processed through its technology is fortified against potential threats, offering both merchants and consumers peace of mind.

- Device Compatibility:

Spectratech’s “Tap to Phone” solutions are meticulously designed for seamless compatibility across a broad spectrum of devices. Whether merchants are utilizing iOS or Android platforms, smartphones or tablets, Spectratech’s technology guarantees a consistent and reliable “Tap to Phone” experience, catering to the diverse tech ecosystems within which businesses operate.

- Intuitive User Interfaces:

Recognizing the paramount importance of user experience, Spectratech places a strong emphasis on intuitive user interfaces in its “Tap to Phone” solutions. This ensures that both merchants and customers can navigate through the payment process effortlessly, contributing to a positive and efficient transaction experience.

- Real-Time Transaction Analytics:

Acknowledging the significance of data-driven insights, Spectratech’s “Tap to Phone” solutions provide real-time transaction analytics. Merchants gain valuable insights into customer behavior, transaction patterns, and other key metrics, empowering them to make informed decisions that drive business growth.

- Customization for Business Needs:

Spectratech understands that businesses have unique requirements, and its “Tap to Phone” solutions are designed to be customizable. Whether it’s adjusting user interfaces to match brand aesthetics or integrating specific functionalities tailored to different industries, Spectratech ensures that its “Tap to Phone” solutions can be tailored to each business’s specific requirements.

The Impact of “Tap to Phone” on the Financial Landscape:

The adoption of “Tap to Phone” technology is catalyzing transformative changes in the financial landscape, contributing to a more efficient, accessible, and secure ecosystem:

- Financial Inclusion:

“Tap to Phone” contributes significantly to financial inclusion by providing small and medium-sized businesses with an affordable and accessible solution for accepting digital payments. This democratization of transaction capabilities empowers businesses that may have faced barriers to entry in the digital payments space.

- Accelerated Digital Transformation:

The adoption of “Tap to Phone” accelerates the ongoing digital transformation of the financial industry. Businesses that embrace this technology position themselves at the forefront of technological advancements, offering customers a modern and streamlined payment experience.

- Reduced Dependency on Cash:

As businesses adopt “Tap to Phone” solutions, consumers are presented with more opportunities to make secure and convenient digital payments. This contributes to the ongoing global trend toward a cashless society, reducing dependency on physical currency and providing a more hygienic payment alternative.

- Increased Flexibility in Payment Options:

“Tap to Phone” technology expands the range of payment options businesses can offer. As consumer preferences evolve, businesses equipped with “Tap to Phone” solutions can adapt quickly to emerging payment trends, staying ahead of the curve in the rapidly changing landscape of digital payments.

- Cost-Effective Implementation:

The cost-effective nature of “Tap to Phone” solutions makes them particularly advantageous for businesses of all sizes. Spectratech’s “Tap to Phone” technology empowers businesses to embrace digital payments without significant upfront hardware investments, making it an accessible and efficient solution.

Conclusion:

In the dynamic world of financial technology, “Tap to Phone” has emerged as a transformative force, offering businesses and consumers a more flexible, efficient, and secure way to conduct transactions. Spectratech, with its cutting-edge security features, device compatibility, intuitive user interfaces, real-time transaction analytics, and customization options, stands as a frontrunner in the realm of “Tap to Phone” technology.

As businesses continue to embrace the transformative capabilities of “Tap to Phone,” the transaction experience is poised to become more seamless, efficient, and customer-centric. Spectratech’s commitment to innovation and excellence positions it as a driving force behind the evolution of “Tap to Phone” technology, contributing to a future where transactions are not just transactions but holistic experiences that empower businesses and delight customers.